ITR Filing with TaxBabu is simple!

Simply take it easy. Leave the pressure of duty recording to us. Allow our specialists to assist you with saving most extreme time and charges.

Enter Your 10 Digits Mobile Number

We have an answer for each issue

Maximum Savings

Our experienced CA’s scan all your documents & use them to save tax.

Human Connection

A to Z tax guidance from the best CA’s at each and every step.

Just get it done

Upload your documents and relax. Leave the rest to us.

Free Notice Compliance

Got a Tax Notice? We will prepare & file the response with no additional cost.

Start filing with your tax expert today

TaxBabu leverages technology to bring expert advice to taxpayers at reasonable cost.

- Salary & HP Plan

₹ 999 Per Year

Inclusive Of Taxes

Suited For:-

- Single & Multiple Employers

- Single & Multiple House Property

- Income from Other Sources

- Agriculture Income

- Business & Professional Plan

₹1,999 Per Year

Inclusive Of Taxes

Suited For:-

- Single & Multiple Employers

- Single & Multiple House Property

- Business & Professional Income(Non Audit)- Without B/S P/L*

- Income from Other Sources

- Agriculture Income

- Capital Gain Plan

₹1,999 Per Year

Inclusive Of Taxes

Suited For:-

- Single & Multiple Employers

- Single & Multiple House Property

- Multiple Capital Gain Income

- Business & Professional Income(Non Audit)- Without B/S P/L*

- Income from Other Sources

- Agriculture Income

-

Future & Options Plan

₹3,499 Per Year

Inclusive Of Taxes

Suited For:-

- F&O Income/Loss(Non Audit)

- Speculative Income

- Single & Multiple Employers

- Single & Multiple House Propertyv

- Multiple Capital Gain Income

- Income from Other Sources

- Business & Professional Income(Non Audit)- Without B/S P/L*

- Agriculture Income

-

Crypto Currency Plan

₹3,999 Per Year

Inclusive Of Taxes

Suited For:-

- Crypto Income

- F&O Income/Loss(Non Audit)

- Speculative Income

- Single & Multiple Employers

- Single & Multiple House Property

- Multiple Capital Gain Income

- Business & Professional Income(Non Audit)- Without B/S P/L*

- Income from Other Sources

- Agriculture Income

-

NRI/Resident Having Foreign Income

₹4,999 Per Year

Inclusive Of Taxes

Suited For:-

- Foreign salary(Including Foreign Tax relief)

- DTAA Tax Relief

- Single & Multiple Employers

- Single & Multiple House Property

- Multiple Capital Gain Income

- RSU/ESOP

- Business & Professional Income(Non Audit)- Without B/S P/L*

- Crypto Income

- F&O Income/Loss(Non Audit)

- Speculative Income

- Income from Other Sources

- Agriculture Income

Income Tax: Old tax regime vs new tax regime and how to switch between the two? MintGenie explains

01 Feb 2024, 01:51 PM IST

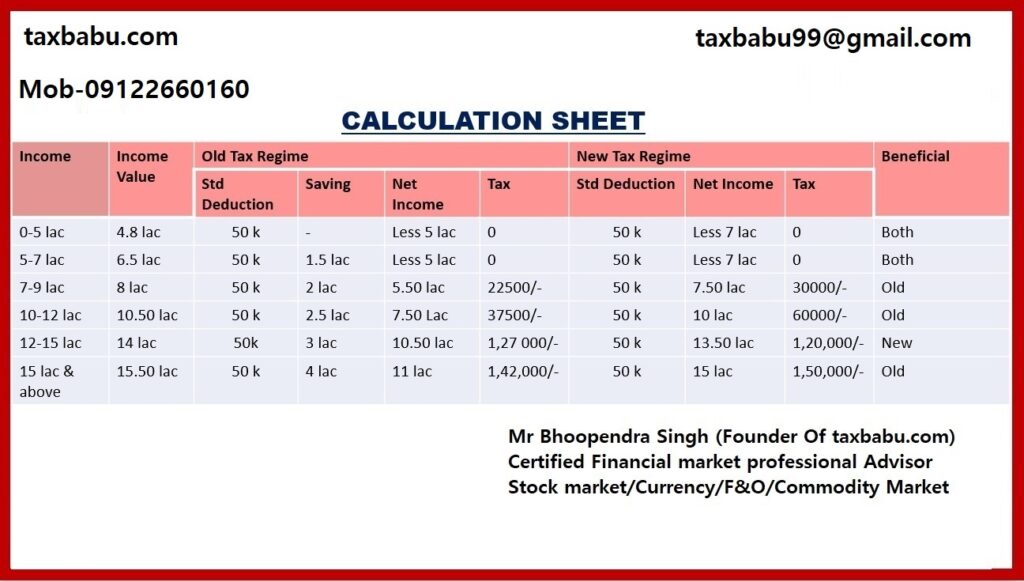

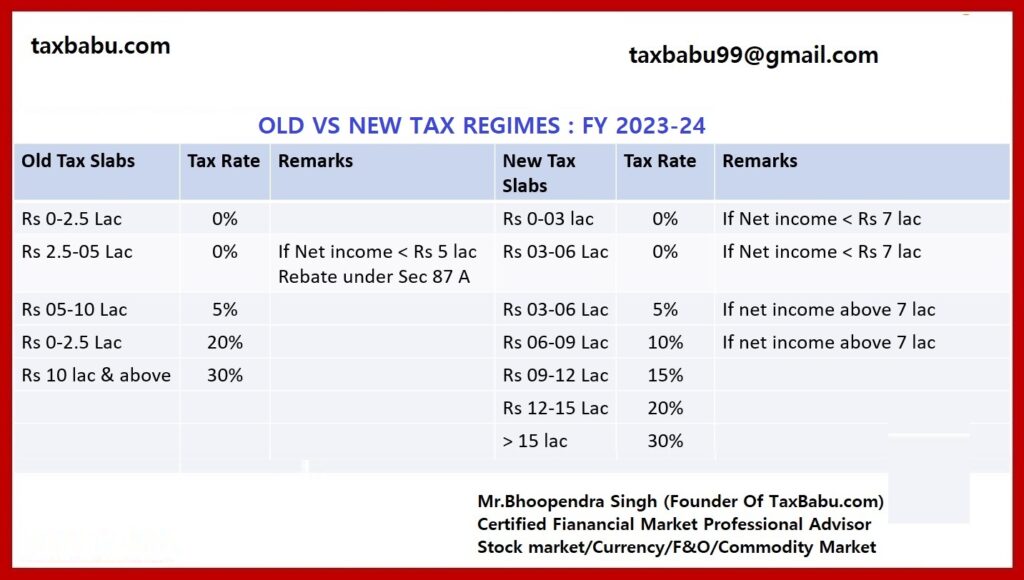

The traditional tax system provides an extensive array of deductions and exemptions, appealing to individuals who can leverage them effectively. The decision between the old and new tax regimes hinges on various factors, such as your income level, investment strategies, and more.

The default adoption of the new tax regime is a notable modification outlined in the Budget 2023. Its objective is to streamline the tax filing procedure and promote greater participation in the new regime, featuring reduced tax rates albeit with fewer deductions and exemptions.

This implies that if you don’t expressly select either the old or new regimes, your taxes will be computed under the new regime by default. Nevertheless, you have the flexibility to revert to the old regime at any time before the due date for filing your return for the applicable assessment year. The frequency of switches allowed is contingent on your profession.

Employees receiving a salary and business professionals have the option to transition between the old and new tax regimes annually. On the other hand, individuals falling outside these categories are permitted to switch between the old and new regimes only once in their lifetime.Given the ongoing conversations about the interim budget and its implications, numerous taxpayers are showing a keen interest in understanding the process of transitioning between the old and new tax regimes to minimize their tax expenditures. If you are not yet acquainted with the consequences of transitioning between tax regimes, reverting to the old regime allows you to access the various deductions and exemptions offered under that system, even though it entails higher tax rates.

Also Read: Income Tax Budget 2024 Live Updates

Interpreting the old tax regime

The previous tax regime, alternatively referred to as the “old tax regime” or the “deduction-based regime”, provides an extensive range of deductions and exemptions, presenting potential advantages for taxpayers who can make effective use of them. The characteristics of the previous tax regime encompass:

- Extensive deductions and exemptions: With more than 70 options, including Section 80C offering a substantial limit of ₹1.5 lakh, these provisions have the potential to substantially decrease your taxable income and reduce your overall tax liability.

- Established system: It served as the primary tax regime for numerous years preceding the introduction of the new tax regime in 2020.

- Taxpayer discretion: Individuals retain the option to choose the old tax regime, even though the new regime is set as the default choice.

Factors to contemplate when selecting the old regime comprise:

- To derive greater benefits from the old regime compared to the new regime, it is essential to leverage a substantial portion of available deductions, typically surpassing 30-40% of your income.

- Handling and asserting multiple deductions can be burdensome, necessitating extra paperwork and possibly increased professional fees for tax preparation.

- Although deductions result in a reduction of taxable income, the old regime features slightly higher tax rates for specific income brackets when compared to the new regime.

Understanding the new tax regime

The introduction of the new tax regime in India in 2020 has undeniably brought about significant changes. Geared towards simplifying the process with reduced tax rates, it does, however, come at the expense of limited deductions and exemptions. Despite being the default choice in Budget 2023, the decision on whether it is the best fit still hinges on individual circumstances.

These are some of the pivotal modifications implemented in the new tax regime for the financial year 2023-24 (assessment year 2024-25). Here is a detailed breakdown of these aspects to consider before choosing the new regime.

- Elevated basic exemption limit and rebate: The basic exemption limit, which represents the income threshold below which no tax is due, has been raised from ₹2.5 lakhs to ₹3 lakhs in the new tax regime. Additionally, the tax rebate under section 87A has been raised from ₹5 lakhs to ₹7 lakhs. Consequently, income up to ₹7 lakhs is now effectively tax-free in the new regime.

- Restoration of basic deduction: The standard deduction of ₹50,000, previously applicable exclusively to the old tax regime, has now been incorporated into the new tax regime. This serves to further decrease the taxable income under the new regime.

- Reduced surcharge: The surcharge rate on income surpassing ₹5 crores has been decreased from 37% to 25% in the new tax regime. This results in a reduced effective tax rate for individuals with high incomes who choose the new regime.

Forms to switch between tax regimes

The Central Board of Direct Taxes (CBDT) has recently unveiled two fresh income tax return forms, namely ITR-1 (SAHAJ) and ITR-4 (SUGAM), applicable for the Assessment Year 2024-25. In the updated ITR Form 1, individuals can now choose their preferred tax regime. Additionally, for ITR-4, which is designed for individuals with business or professional income, taxpayers are required to submit Form 10-IEA to opt out of the new tax regime.

- ITR-1 (SAHAJ): This streamlined form is currently accessible for individuals with income from salary, a single house property, interest income up to ₹2 lakhs, and agricultural income up to ₹5,000. Notably, it now incorporates the provision to directly choose the tax regime (old or new) within the form.

- ITR-4 (SUGAM): Designed for individuals with business or professional income, or income from sources other than salary, house property, or agriculture. Nevertheless, taxpayers using ITR-4 who wish to opt out of the new tax regime must submit an additional Form 10-IEA.

These adjustments simplify the process of filing Income Tax Returns (ITR) for numerous individuals, concurrently providing clarity on the procedure for selecting between tax regimes.

How to switch between tax regimes?

Transitioning between the old tax regime and the new tax regime, and vice versa is not a complex process. By following straightforward steps during the income tax return filing, taxpayers can easily navigate the decision-making process between the regimes and make their selection accordingly.

Step 1: Choose between the old and the new tax regime.

Step 2: Verify if you meet the eligibility criteria.

Step 3: Choose the form from the aforementioned list accordingly.

Step 4: If you are a salaried individual, access your ITR form (such as ITR-1 or ITR-2). Next, navigate to the section dedicated to selecting the tax regime. Choose the “New Tax Regime” option if it is suitable for you. Proceed to fill out the remaining sections of your ITR and submit the form.

Nevertheless, for individuals with business or professional income, download and fill out Form 10IE. Make sure to submit Form 10IE by July 31 of the assessment year. When filing your ITR, choose the “New Tax Regime” option.

In general, individuals with substantial investments, medical expenses, and other eligible deductions may find the old tax regime advantageous. Myriad alterations render the new tax regime more appealing to a broader spectrum of taxpayers, particularly those with lower incomes and individuals who don’t avail themselves of numerous deductions under the old regime. Nevertheless, conducting a thorough analysis and comparing it with the new regime is essential to determine the optimal choice for your specific financial situation.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech:

Crores of taxes saved and counting

Get tax planning, & notice compliance

completely FREE when you file ITR with TaxBabu.

We are India's most trusted tax filing platform

Maximum tax saving guarantee

Live chat with your tax expert

On-demand tax filing support

Support on all devices

Starting from ₹999

Step 1: Calculate Gross total income from salary:

The table below shows the calculation for gross taxable income from salary.

| Component | Amount (Rs.) | Exemption/ Deduction | Old regime | New regime |

|---|---|---|---|---|

| Basic Salary | 600,000 | – | 600,000 | 600,000 |

| HRA | 300,000 | 240,000 | 60,000 | 300,000 |

| Special Allowance | 60,000 | – | 60,000 | 60,000 |

| LTA | 40,000 | 40,000 (bills submitted) | 0 | 40,000 |

| Standard Deduction | – | 50,000 | – 50,000 | |

| Gross Total Income from Salary | – | – | 670,000 | 1,000,000 |

Gross Income from Salary – New Vs Old tax Regime

Step 2: Tax Deductions

Amit had made the following investments to save tax. These will be deducted from the gross income to arrive at net taxable income.

- EPF deduction from salary – Rs 60,000

- PPF Investment – Rs 1,50,000

- Medical Insurance Premium – Rs 25,000

- Total Tax Deduction = Rs 1,50,000 + 25,000 = Rs 1,75,000 (PPF & EPF both come under section 80C and have a tax deduction upper limit of Rs 1.5 lakh)

Step 3: Other Income

Amit also had Rs 20,000 from interest from fixed deposits with banks.

Step 4: Net Taxable Income

The table below shows the Net Taxable Income for Amit

Nature Old Tax Regime New Tax Regime Income from Salary 670,000 1,000,000 Income from Other Sources 20,000 20,000 Tax Deduction -175,000 0 Total Taxable Income 515,000 1,020,000 Step 5: Calculating using Income Tax Formula

Old Regime:

Tax Slab Calculation Tax up to Rs 250,000 Tax Exempt 0 Rs 250,000 to 500,000 5% || (5% * (500,000 – 250,000) 12,500 Rs 500,000 to 1,000,000 20% || (20% *(515,000 – 500,000) 3,000 Income Tax – 15,500 Cess 4% || (4% of 15,500) 620 Total Tax Payable – 16,120 Tax computation using old tax slabs New Regime:

Tax Slab Calculation Tax up to Rs 250,000 Tax Exempt 0 Rs 250,000 to 500,000 5% || (5% * (500,000 – 250,000) 12,500 Rs 500,000 to 750,000 10% || (10% * (750,000 – 500,000) 25,000 Rs 750,000 to 1,000,000 15% || (15% * (1,000,000 – 750,000) 37,500 Rs 1,000,000 to 1,250,000 20% || (20% * (1,020,000 – 1,000,000) 4,000 Income Tax – 79,000 Cess 4% || (4% of 79,000) 3,160 Total Tax payable – 82,160 Tax computation using new tax slabs As you can see the tax liability changes hugely depending on what tax regime you choose. So you should plan carefully. You can also check the official Income Tax website for calculating your income tax.

Income Tax Deductions List – Deductions on Section 80C, 80CCC, 80CCD & 80D – FY 2021-22 (AY 2022-23)

Income tax department with a view to encourage savings and investments amongst the taxpayers have provided various deductions from the taxable income under chapter VI A deductions. 80C being the most famous, there are other deductions which are beneficial for the taxpayers to reduce their tax liability. Let us understand these deductions in detail:

Section 80 Deduction List

- Section 80C Investments

- Section 80CCC Insurance Premium

- Section 80CCD Pension Contribution

- Section 80TTA Interest on Savings Account

- Section 80GG House Rent Paid

- Section 80E Interest on Education Loan

- Section 80EE Interest on Home Loan

- Section 80D Medical Insurance

- Section 80DD Disabled Dependent

- Section 80DDB Medical Expenditure

- Section 80U Physical Disability

- Section 80G Donations

- Section 80GGB Company Contribution

- Section 80GGC Contribution to Political Parties

- Section 80RRB Royalty of a Patent

- Section 80TTB Interest Income

- Frequently Asked Questions

Section 80C – Deductions on Investments

Section 80C is one of the most popular and favourite sections amongst taxpayers as it allows them to reduce taxable income by making tax-saving investments or incurring eligible expenses. It allows a maximum deduction of Rs 1.5 lakh every year from the taxpayer’s total income.

The benefit of this deduction can be availed by Individuals and HUFs. Companies, partnership firms, and LLPs cannot avail the benefit of this deduction.

Section 80C includes subsections, 80CCC, 80CCD (1), 80CCD (1b) and 80CCD (2).

It is important to note that overall limit including the subsections for claiming deduction is Rs 1.5 lakh except an additional deduction of Rs 50,000 allowed u/s 80CCD(1b)

Section 80C and its subsections

| Sections | Eligible investments for tax deductions |

|---|---|

| 80C | Payments made towards life insurance premiums, Equity Linked Saving Schemes, payments made towards the principal sum of a home loan, SSY, NSC, SCSS, and so on. |

| 80CCC | Payment made towards pension plans, and mutual funds. |

| 80CCD (1) | Payments paid to government-sponsored plans such as the National Pension System, the Atal Pension Yojana, and others. |

| 80CCD (1B) | Investments of up to Rs.50,000 in NPS. |

| 80CCD (2) | Employer’s contribution towards NPS (up to 10%, comprising basic salary and dearness allowance, if any) |

Here are some investment options that are allowed as deduction u/s 80C. They not only help you with saving taxes but also help you grow your money. A quick comparison of the options is tabulated below:

Section 80C Deductions List

| Investment options | Average Interest | Lock-in period for | Risk factor |

| ELSS funds | 12% – 15% | 3 years | High |

| NPS Scheme | 8% – 10% | Till 60 years of age | High |

| ULIP | 8% – 10% | 5 years | Medium |

| Tax saving FD | Up to 8.40% | 5 years | Low |

| PPF | 7.90% | 15 years | Low |

| Senior citizen savings scheme | 8.60% | 5years (can be extended for other 3 years) | Low |

| National Savings Certificate | 7.9% | 5 years | Low |

| Sukanya Samriddhi Yojana | 8.50% | Till girl child reaches 21 years of age (partial withdrawal allowed when she reached 18 years) | Low |

Get Savings on Income Taxes With a Tax Expert to Help You File

Sometimes, you may have deductions or investments eligible for 80C but haven’t submitted proof to your employer. This may cause additional TDS deductions. You can still claim these deductions while e-filing, as long as you have the

Section 80TTA – Interest on Savings Accounts

If you are an individual or a HUF, you may claim a deduction of a maximum Rs 10,000 against interest income from your savings account with a bank, co-operative society, or post office. Do include the interest from a savings bank account in other income.

Section 80TTA deduction is not available on the interest income from fixed deposits, recurring deposits, or interest income from corporate bonds.

Section 80TTB – Interest From Deposits Held by Senior Citizens

Section 80TTB provides a deduction of up to Rs 50,000 for interest income earned on deposits held by resident senior people (age 60 or more) with a banking firm, a post office, a co-operative, a society engaged in the banking business, and so on. As a result, the maximum for TDS deduction under Section 194A for older citizens has been enhanced to Rs. 50,000. In these instances, however, no deduction under section 80TTA is permitted. It should be noted that senior citizens aged 75 and up who receive just pension and interest income are exempt from ITR filing because tax is deducted at the source by banks.

Section 80GG – Income Tax Deduction on House Rent Paid

a. Section 80GG deduction is available for rent paid when HRA is not received. The taxpayer, spouse or minor child should not own residential accommodation at the place of employment

b. The taxpayer should not have self-occupied residential property in any other place

c. The taxpayer must be living on rent and paying rent

d. The deduction is available to all individuals

Deduction available is the least of the following:

a. Rent paid minus 10% of adjusted total income

b. Rs 5,000/- per month

c. 25% of adjusted total income*

*Adjusted Gross Total Income is arrived at after adjusting the Gross Total Income for certain deductions, exempt income, long-term capital gains and income related to non-residents and foreign companies.

An online ITR e-filing software like that of Tax Babu can be extremely easy as the limits are auto-calculated. So, you do not have to worry about making complex calculations.

From FY 2016-17 available deduction has been raised to Rs 5,000 a month from Rs 2,000 per month.

Section 80E – Interest on Education Loan

A deduction is allowed to an individual for interest on loans taken for pursuing higher education. This loan may have been taken for the taxpayer, spouse or children or for a student for whom the taxpayer is a legal guardian.

80E deduction is available for a maximum of 8 years (beginning the year in which the interest starts getting repaid) or till the entire interest is repaid, whichever is earlier. There is no restriction on the amount that can be claimed.

Easy and Accurate ITR Filing on Taxbabu

File in 3 Mins | 100% Pre-Fill | No Manual Entry

Section 80EEA – Interest on Home Loan For First-Time Home Owners

This is Section 80EEA, which provides taxpayers with an extra deduction for paying interest on a house loan. Whereas Section 24 exempted interest on home loans up to Rs 2 lakh, this section exempts home buyers who take out a home loan and pay interest on the loan an additional Rs 1.5 lakhs. Read in detail here.

FY 2017-18 and FY 2016-17

This deduction is available in FY 2017-18 if the loan has been taken in FY 2016-17.

The deduction under section 80EE is available only to home-owners (individuals) having only one house property on the date of sanction of the loan. The value of the property must be less than Rs 50 lakh and the home loan must be less than Rs 35 lakh. The loan taken from a financial institution must have been sanctioned between 1 April 2016 and 31 March 2017.

There is an additional deduction of Rs 50,000 available on your home loan interest on top of the deduction of Rs 2 lakh (on the interest component of home loan EMI) allowed under section 24.

FY 2013-14 and FY 2014-15

During these financial years, the deduction available under this section was a first-time house worth Rs 40 lakh or less. You can avail this only when your loan amount during this period is Rs 25 lakh or less. The loan must be sanctioned between 1 April 2013 and 31 March 2014. The aggregate deduction allowed under this section cannot exceed Rs 1 lakh and is allowed for FY 2013-14 and FY 2014-15.

Section 80D – Deduction on Medical Insurance Premium

You (as an individual or HUF) can claim a deduction of Rs.25,000 under section 80D on insurance for self, spouse and dependent children. An additional deduction for insurance of parents is available up to Rs 25,000, if they are less than 60 years of age. If the parents are aged above 60, the deduction amount is Rs 50,000, which has been increased in Budget 2018 from Rs 30,000.

In case, both taxpayer and parent(s) are 60 years or above, the maximum deduction available under this section is up to Rs.1 lakh.

Example: Rohan’s age is 65 and his father’s age is 90. In this case, the maximum deduction Rohan can claim under section 80D is Rs. 100,000.

From FY 2015-16 a cumulative additional deduction of Rs. 5,000 is allowed for preventive health check.

Section 80DD – Deduction for Medical Treatment of a Dependent with Disability

Section 80DD deduction is available to a resident individual or a HUF and is available on:

a. Expenditure incurred on medical treatment (including nursing), training and rehabilitation of handicapped dependent relative

b. Payment or deposit to specified scheme for maintenance of handicapped dependent relative.

i. Where disability is 40% or more but less than 80% – a fixed deduction of Rs 75,000.

ii. Where there is a severe disability (disability is 80% or more) – a fixed deduction of Rs 1,25,000.

To claim this deduction a certificate of disability is required from the prescribed medical authority.

From FY 2015-16 – The deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Section 80DDB – Deduction for Specified Diseases

a. For individuals and HUFs below age 60

A deduction up to Rs.40,000 is available to a resident individual or a HUF. It is available with respect to any expense incurred towards treatment of specified medical diseases or ailments for himself or any of his dependents. For an HUF, such a deduction is available with respect to medical expenses incurred towards these prescribed ailments for any of the HUF members.

b. For senior citizens and super senior citizens

In case the individual on behalf of whom such expenses are incurred is a senior citizen, the individual or HUF taxpayer can claim a deduction up to Rs 1 lakh. Until FY 2017-18, the deduction that could be claimed for a senior citizen and a super senior citizen was Rs 60,000 and Rs 80,000 respectively. This has now become a common deduction available upto Rs 1 lakh for all senior citizens (including super senior citizens) unlike earlier.

c. For reimbursement claims

Any reimbursement of medical expenses by an insurer or employer shall be reduced from the quantum of deduction the taxpayer can claim under this section.

Also, remember that you need to get a prescription for such medical treatment from the concerned specialist to claim such a deduction. Read our detailed article on Section 80DDB.

Section 80U – Deduction for Disabled Individuals

A deduction of Rs.75,000 is available to a resident individual who suffers from a physical disability (including blindness) or mental retardation. In case of severe disability, one can claim a deduction of Rs 1,25,000.

From FY 2015-16 – Section 80U deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Section 80G – Income Tax Benefits Towards Donations for Social Causes

The various donations specified in u/s 80G are eligible for deduction up to either 100% or 50% with or without restriction.

From FY 2017-18, any donations made in cash exceeding Rs 2,000 will not be allowed as a deduction. Donations above Rs 2000 should be made in any mode other than cash to qualify for an 80G deduction.

a. Donations with 100% deduction without any qualifying limit

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- Fund set up by a State Government for the medical relief to the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

- National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- National Children’s Fund

- Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund with respect to any State or Union Territory

- The Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The Maharashtra Chief Minister’s Relief Fund during October 1, 1993 and October 6,1993

- Chief Minister’s Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of earthquake in Gujarat (contribution made during January 26, 2001 and September 30, 2001) or

- Prime Minister’s Armenia Earthquake Relief Fund

- Africa (Public Contributions — India) Fund

- Swachh Bharat Kosh (applicable from financial year 2014-15)

- Clean Ganga Fund (applicable from financial year 2014-15)

- National Fund for Control of Drug Abuse (applicable from financial year 2015-16)

b. Donations with 50% deduction without any qualifying limit

- Jawaharlal Nehru Memorial Fund

- Prime Minister’s Drought Relief Fund

- Indira Gandhi Memorial Trust

- The Rajiv Gandhi Foundation

c. Donations to the following are eligible for 100% deduction subject to 10% of adjusted gross total income

- Government or any approved local authority, institution or association to be utilized for the purpose of promoting family planning

- Donation by a Company to the Indian Olympic Association or to any other notified association or institution established in India for the development of infrastructure for sports and games in India or the sponsorship of sports and games in India

d. Donations to the following are eligible for 50% deduction subject to 10% of adjusted gross total income

- Any other fund or any institution which satisfies conditions mentioned in Section 80G(5)

- Government or any local authority to be utilised for any charitable purpose other than the purpose of promoting family planning

- Any authority constituted in India for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns, villages or both

- Any corporation referred in Section 10(26BB) for promoting the interest of minority community

- For repairs or renovation of any notified temple, mosque, gurudwara, church or other places.

Section 80GGB – Company Donation to Political Parties

Section 80GGB deduction is allowed to an Indian company for the amount contributed by it to any political party or an electoral trust. A deduction is allowed for contributions done in any way other than cash.

Section 80GGC – Deduction on Donations By a Person to Political Parties

Deduction under section 80GGC is allowed to an individual taxpayer for any amount contributed to a political party or an electoral trust. It is not available for companies, local authorities and an artificial juridical person wholly or partly funded by the government. You can avail this deduction only if you pay in any way other than cash.

Section 80RRB – Deduction on Income via Royalty of a Patent

80RRB Deduction for any income by way of royalty for a patent, registered on or after 1 April 2003 under the Patents Act 1970, shall be available for up to Rs.3 lakh or the income received, whichever is less. The taxpayer must be an individual patentee and an Indian resident. The taxpayer must furnish a certificate in the prescribed form duly signed by the prescribed authority.

Section 80TTB – Interest Income on Deposits for Senior Citizens

A new section 80TTB has been inserted vide Budget 2018 in which deductions with respect to interest income from deposits held by senior citizens will be allowed. The limit for this deduction is Rs.50,000.

No further deduction under section 80TTA shall be allowed. In addition to section 80 TTB, section 194A of the Act will also be amended so as to increase the threshold limit for TDS on interest income payable to senior citizens. The earlier limit was Rs 10,000, which was increased to Rs 50,000 as per the latest Budget.

Section 80 Deductions Summary Table

| Section | Deduction on | Allowed Limit (maximum) FY 2022-23 |

|---|---|---|

| 80C | Investment in PPF – Employee’s share of PF contribution – NSCs – Life Insurance Premium payment – Children’s Tuition Fee – Principal Repayment of home loan – Investment in Sukanya Samridhi Account – ULIPS – ELSS – Sum paid to purchase deferred annuity – Five year deposit scheme – Senior Citizens savings scheme – Subscription to notified securities/notified deposits scheme – Contribution to notified Pension Fund set up by Mutual Fund or UTI. – Subscription to Home Loan Account scheme of the National Housing Bank – Subscription to deposit scheme of a public sector or company engaged in providing housing finance – Contribution to notified annuity Plan of LIC – Subscription to equity shares/ debentures of an approved eligible issue – Subscription to notified bonds of NABARD | Rs. 1,50,000 |

| 80CCC | For amount deposited in annuity plan of LIC or any other insurer for a pension from a fund referred to in Section 10(23AAB) | – |

| 80CCD(1) | Employee’s contribution to NPS account (maximum up to Rs 1,50,000) | – |

| 80CCD(2) | Employer’s contribution to NPS account | Maximum up to 10% of salary |

| 80CCD(1B) | Additional contribution to NPS | Rs. 50,000 |

| 80TTA(1) | Interest Income from Savings account | Maximum up to 10,000 |

| 80TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to 50,000 |

| 80GG | For rent paid when HRA is not received from employer | Least of : – Rent paid minus 10% of total income – Rs. 5000/- per month – 25% of total income |

| 80E | Interest on education loan | Interest paid for a period of 8 years |

| 80EE | Interest on home loan for first time home owners | Rs 50,000 |

| 80D | Medical Insurance – Self, spouse, children Medical Insurance – Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old | – Rs. 25,000 – Rs. 50,000 |

| 80DD | Medical treatment for handicapped dependent or payment to specified scheme for maintenance of handicapped dependent – Disability is 40% or more but less than 80% – Disability is 80% or more | – Rs. 75,000 – Rs. 1,25,000 |

| 80DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD – For less than 60 years old – For more than 60 years old | – Lower of Rs 40,000 or the amount actually paid – Lower of Rs 1,00,000 or the amount actually paid |

| 80U | Self-suffering from disability : – An individual suffering from a physical disability (including blindness) or mental retardation. – An individual suffering from severe disability | – Rs. 75,000 – Rs. 1,25,000 |

| 80GGB | Contribution by companies to political parties | Amount contributed (not allowed if paid in cash) |

| 80GGC | Contribution by individuals to political parties | Amount contributed (not allowed if paid in cash) |

| 80RRB | Deductions on Income by way of Royalty of a Patent | Lower of Rs 3,00,000 or income received |

Frequently Asked Questions

Can I claim the 80C deductions at the time of filing the return in case I have not submitted proof to my employer?

I have made an 80C investment on 30 April 2021. For which year can I claim this investment as a deduction?

I have availed a loan from my employer for pursuing higher education. Can I claim the interest paid on such a loan as a deduction under Section 80E?

Is there any restriction or maximum limit up to which I can claim a deduction under Section 80E?

Can a company or a firm take benefit of Section 80C?

I have been paying life insurance premiums to a private insurance company. Can I claim an 80C deduction for the premium paid?

In which year can I claim a deduction of the stamp duty paid for the purchase of a house property

Can a company claim a deduction for donations made under Section 80G

I am paying medical insurance premiums for a medical policy taken in my name, my wife and my children’s. I am also paying the premium on a medical policy taken in the name of my parents who are above 60 years. Can I claim a deduction for both premiums paid?

Is my FD interest exempt under Section 80TTB?

What do you mean by 80C deduction under chapter VI A?

How to calculate deduction u/s 80c?

For section 80C- The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1.5 lakh.

The limit of Rs 1.5 lakh deduction of Section 80C includes 80CCC (contribution towards pension plan) and 80CCD (1), 80CCD (1b) and 80CCD (2).

Section 80CCCD (1) is a contribution towards the National pension scheme by the employee or self-employed and is limited to 10% of salary (basisc + DA) or 20% of gross total income for self employed.

Section 80CCD (1b) provides additional deduction of Rs 50,000 for contributions towards NPS , Atal pension Yojana etc. This deduction is over and above Rs 1.5 lakh. Hence total of deduction including 80C and 80CCD (1b) can be maximum Rs 2 lakh for a single year.

Section 80CCD (2) is deduction allowed to salaried for contributions made by their employer for NPS , this is also allowed at 10 % of salary (basic +DA) . However it is important to note that there is no upper limit in 80CCD (2)

Hence for investment in 80C only , the limit is Rs 1.5 Lakh. For investment together in 80C, 80CCD (1) and 80CCD (1b), one may invest upto Rs 2 lakh in total. Whereas, a salaried employee can avail more deduction without restriction of limit of Rs 2 lakh under section 80CCD (2) if the employer contributes towards NPS account subject to 10% of salary.

Further please note that per Budget 2020, any contribution towards EPF, NPS and superannuation will be added to the salary as “perquisites” and taxable under salaries in the hands of employees.

Can you claim HRA under section 80?

What is 80GG in income tax? What is rent paid under 80GG ?

How to calculate 80GG? How to claim 80GG?

80GG deduction will be allowed as lowest of below mentioned :

- Rs 5,000 per month

- 25% of the adjusted total Income (excluding long-term capital gains, short-term capital gains under section 111A and Income under Section 115A or 115D and deductions under 80C to 80U. Also, income is before making a deduction under section 80GG).

- Actual rent less 10% of Income

Who can claim deduction in 80GG?

What is section 80CCD ?

What is section 80CCD (1b)?

What is section 80CCD (1) ?

What is section 80CCD (2)?

What is section 80TTB?

What is rebate u/s 87A?

A rebate under section 87A is one of the income tax provisions that help low income earning taxpayers reduce their income tax liability. Taxpayers earning an income below a certain limit have the benefit of paying marginally lower taxes. A Taxpayer can claim the benefit of rebate under section 87A for FY 2020-21 and 2021-22 only if the following conditions are satisfied:

- You are a resident individual

- Your total income after reducing the deductions under chapter VI-A (Section 80C, 80D and so on) does not exceed Rs 5 lakh in an FY

The tax rebate is limited to Rs 12,500. This means, if your total tax payable is less than Rs 12,500, then you will not have to pay any tax. Do note that the rebate will be applied to the total tax before adding the health and education cess of 4%.

Who is eligible for rebate u/s 87a?

A Taxpayer can claim the benefit of rebate under section 87A for FY 2020-21 and 2021-22 only if the following conditions are satisfied:

- You are a resident individual which means HUF and firms cannot claim this rebate.

- Your total income after reducing the deductions under chapter VI-A (Section 80C, 80D and so on) does not exceed Rs 5 lakh in an FY

Finish your E-filing with Tax Babu

Finish your E-filing with Taxbabu

- File your returns in just 3 minutes

- 100% pre-fill. No manual data entry

- Section 80 Deduction List

- Section 80C – Deductions on Investments

- Section 80C and its subsections

- Section 80C Deductions List

- Section 80TTA – Interest on Savings Accounts

- Section 80TTB – Interest From Deposits Held by Senior Citizens

- Section 80GG – Income Tax Deduction on House Rent Paid

- Section 80E – Interest on Education Loan

- Easy and Accurate ITR Filing on ClearTax

- Section 80EEA – Interest on Home Loan For First-Time Home Owners

- Section 80D – Deduction on Medical Insurance Premium

- Section 80DD – Deduction for Medical Treatment of a Dependent with Disability

- Section 80DDB – Deduction for Specified Diseases

- Section 80U – Deduction for Disabled Individuals

- Section 80G – Income Tax Benefits Towards Donations for Social Causes

- Section 80GGB – Company Donation to Political Parties

- Section 80GGC – Deduction on Donations By a Person to Political Parties

- Section 80RRB – Deduction on Income via Royalty of a Patent

- Section 80TTB – Interest Income on Deposits for Senior Citizens

- Section 80 Deductions Summary Table

- Frequently Asked Questions

- What is 80GG in income tax? What is rent paid under 80GG ?

- How to calculate 80GG? How to claim 80GG?

- Who can claim deduction in 80GG?

- What is section 80CCD ?

- What is section 80CCD (1b)?

- What is section 80CCD (1) ?

- What is section 80CCD (2)?

- What is section 80TTB?

- What is rebate u/s 87A?

- Who is eligible for rebate u/s 87a?

Special Allowance in India – Taxation & Calculation

Allowance is a fixed quantity of money given by employers to their employees to meet certain special requirements. This amount is given besides the salary. These allowances may attract exemption in certain cases. Otherwise, they are considered as a part of the total income of employees and are taxable. Read through to know how special allowance is different.

What is a special allowance?

Certain allowances are exempted under Section 10(14) of the Income Tax Act, 1961. Section 10(14) says that:

- Any special allowance/benefit, not a perquisite, as per the meaning specified in clause (2) of Section 17, is granted for the employees to meet certain expenses wholly. These expenses must be incurred while performing the duties of an office or employment of profit.

- Any allowance granted to the employee either to meet personal expenses at the office/employment for profit performed by him or to compensate him for the high cost of living.

In these cases, the allowance provided is exempted from taxes.

How is the special allowance taxed?

Certain categories of taxes are fully exempted such as allowances given to judges at the Supreme Court and the High Courts. Allowances such as house rent allowance are partially exempted as per Section 10(13A). Other allowances such as city compensatory allowance are fully taxable.

Special allowance categories and the corresponding exemptions

- Transport Allowance: In the case of handicapped employees, an exemption up to Rs.3,200 is provided.

- Tribal Area Allowance: A special allowance is provided to the residents of hilly, scheduled, and agency areas such as Uttar Pradesh, Karnataka, Madhya Pradesh, Tamil Nadu, Odisha, Assam, and Tripura. You can get an exemption of up to Rs.200 per month.

- Outstation Allowance: This is an allowance provided by roadways, railways, and airways in place of the daily allowance. The exemption applicable is 70% of the allowance or Rs.10,000, whichever is lower.

- Hostel Allowance: An exemption of up to Rs.300 per month per child for two children.

- Island Duty Allowance: This allowance is provided to the members of the armed forces who are assigned duties in islands such as Lakshadweep and Andaman & Nicobar. A maximum exemption of up to Rs.3,250 is given per month.

- Children’s Education Allowance: A maximum exemption of up to Rs.100 per month per child for two children.

- Uniform Allowance: You can get an allowance for the expenses incurred in purchasing and maintaining the uniform to be worn to the employment of profit/office.

- Academic/Research Allowance: Academic/research allowance is given to encourage research/training in research institutions.

- Travelling Allowance: The allowance is applicable to supplement the cost of travel when you are out on a tour or on the transfer of duty to another city.

- Daily Allowance: Daily allowance includes charges incurred on a daily basis when on a tour.

- Helper Allowance: If you have hired an assistant to fulfil the duties of your employment, the expenditures incurred can get an allowance.

Special allowance categories and the corresponding exemptions

Many people may think that a special allowance is a part of variable income. However, you must know that a special allowance is considered as part of the gross salary. In addition, the allocation of a special allowance depends on the company’s policies. Therefore, if company A provides a special allowance to all its employees, it does not mean that company B also must provide a special allowance to all employees in the same ratio.

To know the total amount you have received under the special allowance component of the salary, you must sum up the figures provided under each eligible allowance head from the above list that is applicable to you. Refer your salary slip to know more about the allocation towards special allowances.

Illustration

Consider the scenario in which Ms V is an employee at company A. When she checks her salary slip, she realises that a conveyance allowance of Rs.1,600 per month. This allowance is provided on the expenses incurred to travel from the place of residence to the place of work.

In another case, Mr C is a medical practitioner working in the public sector. He was deployed for duty at a medical camp in the rural side of Bidar, Karnataka. This place is inhabited by tribes. Now, Mr C gets an additional component in the salary – tribal area allowance.

DEDUCTIONS*

[AY 2023-24]

| Section | Nature of deduction | Who can claim | |

| (1) | (2) | (3) | |

| Against ‘salaries’ | |||

| 16(ia) | Standard Deduction [Rs. 50,000 or the amount of salary, whichever is lower] | Individual – Salaried Employee & Pensioners | |

| 16(ii) | Entertainment allowance [actual or at the rate of 1/5th of salary, whichever is less] [limited to Rs. 5,000] | Government employees | |

| 16(iii) | Employment tax | Salaried assessees | |

| Against ‘income from house properties’ | |||

| 23(1), first proviso | Taxes levied by local authority and borne by owner if paid in relevant previous year | All assessees | |

| 24(a) | Standard deduction [30% of the annual value (gross annual value less municipal taxes)] | All assessees | |

| 24(b) | Interest on borrowed capital (Rs. 30,000/Rs. 2,00,000, subject to specified conditions) | All assessees | |

| 25A(2) | Standard deduction of 30 per cent of arrears of rent or unrealised rent received | All assessees | |

Against ‘profits and gains of business or profession’ A. Deductible items | |||

| 30 | Rent, rates, taxes, repairs (excluding capital expenditure) and insurance for premises | All assessees | |

| 31 | Repairs (excluding capital expenditure) and insurance of machinery, plant and furniture | All assessees | |

| 32(1)(i) | Depreciation1 in respect of following assets shall be allowed at prescribed percentage on actual cost of an asset (i.e., Straight Line Method): i. Tangible Assets (buildings, machinery, plant or furniture); ii. Intangible Assets (know-how, patents, copyrights, trademarks, licenses, franchises, or any other business or commercial rights of similar nature). However, if asset is acquired and put to use for less than 180 days during the previous year, the deduction shall be restricted to 50% of depreciation computed above. Note: Taxpayers engaged in business of generation or generation and distribution of power have the option to claim depreciation on written down value basis also | Taxpayer engaged in business of generation or generation and distribution of power. | |

| 32(1)(ii) | Depreciation1 in respect of following assets shall be allowed at prescribed percentage on written down value of each block of asset (as per WDV method): i. Tangible Assets (buildings, machinery, plant or furniture); ii. Intangible Assets (know-how, patents, copyrights, trademarks, licenses, franchises, or any other business or commercial rights of similar nature not being goodwill of business or profession). However, if asset is acquired and put to use for less than 180 days during the previous year, the deduction shall be restricted to 50% of depreciation computed above. | All assessees engaged in business or profession | |

| 32(1)(iia) | Additional depreciation shall be allowed at 20% of actual cost of new plant and machinery [other than ships, aircraft, office appliances, second hand plant or machinery, etc.] (Subject to certain conditions). However, if an asset is acquired and put to use for less than 180 days during the previous year, 50% of additional depreciation shall be allowed in year of acquisition and balance 50% would be allowed in the next year. | All taxpayers engaged in: a) manufacture or production of any article or thing; or b) generation, transmission or distribution of power (if taxpayer is not claiming depreciation on straight line basis ). | |

| Proviso to Section 32(1)(iia) | Additional depreciation shall be allowed at 35% of actual cost of new plant and machinery [other than ships, aircraft, office appliances, second hand plant or machinery, etc.] (Subject to certain conditions). However, if an asset is acquired and put to use for less than 180 days during the previous year, 50% of additional depreciation shall be allowed in year of acquisition and balance 50% would be allowed in the next year. Note: 1. Manufacturing unit should be set-up on or after April 1, 2015. 2. New plant and machinery should be acquired and installed on or after April 1, 2015 but before April 1, 2020. | All taxpayers setting-up an undertaking or enterprise for production or manufacture of any article or thing in any notified backward area in the state of Andhra Pradesh, Bihar, Telangana or West Bengal. | |

| 32AC | Investment allowance shall be allowed at 15% of actual cost of new asset acquired and installed by a company engaged in business or manufacturing or production of any article or thing (Subject to certain conditions) Note: Deduction shall be available if actual cost of new plant and machinery acquired and installed by the company during the previous year exceeds Rs. 25/100 Crores, as the case may be | Company engaged in business of manufacturing or production of any article or thing. | |

| 32AD | Investment allowance shall be allowed at 15% of actual cost of investment made in new plant and machinery (other than ships, aircraft, vehicle, office appliances, second hand plant or machinery, etc.) if manufacturing unit is set-up in notified backward area in the State of Andhra Pradesh, Bihar, Telangana or West Bengal (subject to certain conditions). Note: 1. New asset should be acquired and installed on or after April 1, 2015 but before April 1, 2020. 2. Manufacturing unit should be set-up on or after April 1, 2015. 3. Deduction shall be allowed under section 32AD in addition to deduction under section 32AC if assessee fulfils the specified conditions. | All taxpayers who acquire new plant and machinery for purpose of setting-up manufacturing unit in notified backward areas in the State of Andhra Pradesh, Bihar, Telangana or West Bengal | |

| 33A | Development allowance – 50 per cent of actual cost of planting (subject to certain conditions and limits) (planting should have been completed before 1-4-1990) | Assessee engaged in business of growing and manufacturing tea in India | |

| 33AB | Tea/Coffee/Rubber Development Account – Amount deposited in account with National Bank (Special Account) or in Deposit Account of Tea Board, Coffee Board or Rubber Board in accordance with approved scheme or 40% of profits of business, whichever is less (subject to certain conditions) | Assessees engaged in business of growing and manufacturing tea/Coffee/Rubber in India | |

| 33ABA | Amount deposited in Special Account with SBI/Site Restoration Account or 20 per cent of profits, whichever is less (subject to certain conditions) | Assessee carrying on business of prospecting for, or extraction or production of, petroleum or natural gas or both in India | |

| 35(1)(i) | Revenue expenditure on scientific research pertaining to business of assessee is allowed as deduction (Subject to certain conditions). Note: Expenditure on scientific research incurred within 3 years before commencement of business (in the nature of purchase of materials and salary of employees other than perquisite) is allowed as deduction in the year of commencement of business to the extent certified by prescribed authority. | All assessee | |

| 35(1)(ii) | 100% of contribution made to approved research association, university, college or other institution to be used for scientific research shall be allowed as deduction (Subject to certain conditions) | All assessee | |

| 35(1)(iia) | 100% of contribution made to an approved company registered in India to be used for the purpose of scientific research is allowed as deduction (Subject to certain conditions) | All assessee | |

| 35(1)(iii) | 100% of contribution made to approved research association, university, college or other institution with objects of undertaking statistical research or research in social sciences shall be allowed as deduction (Subject to certain conditions) | All assessee | |

| 35(1)(iv) read with 35(2) | Capital expenditure incurred during the year on scientific research relating to the business carried on by the assessee is allowed as deduction (Subject to certain conditions) Capital expenditure incurred within 3 years before commencement of business is allowed as deduction in the year of commencement of business. Note: i. Capital expenditure excludes land and any interest in land; ii. No depreciation shall be allowed on such assets. | All assessee | |

| 35(2AA) | 100% of payment made to a National Laboratory or University or an Indian Institute of Technology or a specified person is allowed as deduction (Subject to certain conditions). The payment should be made with the specified direction that the sum shall be used in a scientific research undertaken under an approved programme. | All assessee | |

| 35(2AB) | 100% of any expenditure incurred by a company on scientific research (including capital expenditure other than on land and building) on in-house scientific research and development facilities as approved by the prescribed authorities shall be allowed as deduction (Subject to certain conditions). Note: Company should enter into an agreement with the prescribed authority for co-operation in such research and development and fulfils such conditions with regard to maintenance of accounts and audit thereof and furnishing of reports in such manner as may be prescribed; | Company engaged in business of bio-technology or in any business of manufacturing or production of eligible articles or things | |

| 35A | Expenditure incurred before 1-4-1998 on acquisition of patent rights or copyrights [equal to appropriate fraction of expenditure on acquisition to be deducted in fourteen equal annual instalments beginning with previous year in which such expenditure has been incurred] (subject to certain conditions) | All assessees | |

| 35AB | Lump sum payment made in any previous year relevant to assessment year commencing on or before 1-4-1998, for acquisition of technical know-how [consideration for acquisition to be deducted in six equal annual instalments (3 equal annual instalments where know-how is developed in certain laboratories, universities and institutions)] (subject to certain conditions) | All assessees | |

| 35ABA | Capital expenditure incurred and actually paid for acquiring any right to use spectrum for telecommunication services shall be allowed as deduction over the useful life of the spectrum in equal instalments | All Assessee engaged in telecommunication services | |

| 35ABB | Expenditure incurred for obtaining licence to operate telecommunication services either before commencement of such business or thereafter at any time during any previous year | All assessees | |

| 35AD | Capital expenditure incurred, wholly and exclusively, for the purpose of any specified business [setting up and operating a cold chain facility; setting up and operating a warehousing facility for storage of agricultural produce; laying and operating a cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being an integral part of such network; building and operating, anywhere in India, a hotel of two-star or above category as classified by the Central Government; building and operating, anywhere in India, a hospital with at least one hundred beds for patients; developing and building a notified housing project under a scheme for slum redevelopment or rehabilitation framed by the Government, as the case may be, in accordance with prescribed guidelines; developing and building a notified housing project under a scheme for affordable housing framed by the Government, as the case may be, in accordance with prescribed guidelines; production of fertilizer in India; setting up and operating an inland container depot or a container freight station which is approved/notified under the Customs Act, 1962; bee-keeping and production of honey and beeswax; and setting up and operating a warehousing facility for storage of sugar. Lying and operating a slurry pipeline for the transportation of iron ore; setting-up and operating a notified semi-conductor wafer fabrication manufacturing unit; developing or maintaining and operating or developing, maintaining and operating a new infrastructure facility4, carried on by the assessee during the previous year in which such expenditure is incurred (subject to certain conditions) Note: No deduction of any capital expenditure above Rs 10,000 shall be allowed where such expenditure is incurred otherwise than by an account payee cheque drawn on a bank or an account payee bank draft or use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed. | All assessees Note: Such deduction is available to Indian company in case of following business, namely;- i) Business of laying and operating a cross-country natural gas or crude or petroleum oil pipeline network. ii) Developing or maintaining and operating or developing, maintaining and operating a new infrastructure facility. | |

| 35CCA | Payment to associations/institutions for carrying out rural development programmes (subject to certain conditions) | All assessees | |

| 35CCB | Expenditure incurred before 1-4-2002 by way of payment to approved associations/institutions for carrying out approved programmes of conservation of natural resources or afforestation (subject to certain conditions) | All assessees | |

| 35CCC | 100% of expenditure on notified agricultural extension project (subject to certain conditions) | All assessees | |

| 35CCD | 100% of expenditure on notified skill development project (subject to certain conditions) | A company | |

| 35D | Amortisation of certain preliminary expenses [deductible in 5 equal annual instalments] (subject to certain conditions) | Indian companies and resident non-corporate assessees | |

| 35DD | Amortisation of expenditure incurred after 31-3-1999 in case of amalgamation or demerger in the hands of an Indian company (one-fifth of such expenditure for 5 successive previous years) (subject to certain conditions) | Indian Company | |

| 35DDA | Amortisation of expenditure incurred under voluntary retirement scheme in 5 equal annual instalments starting with the year when the expenditure is incurred | All assessees | |

| 35E | Expenditure on prospecting, etc., for certain minerals [deductible in ten equal annual instalments] (subject to certain conditions) | Indian companies and resident non-corporate assessees engaged in prospecting, etc., for minerals | |

| 36(1)(i) | Insurance premium covering risk of damage or destruction of stocks/stores | All assessees | |

| 36(1)(ia) | Insurance premium covering life of cattle owned by a member of co-operative society engaged in supplying milk to federal milk co-operative society | Federal milk co-operative societies | |

| 36(1)(ib) | Medical insurance premium paid by any mode other than cash, to insure employee’s health under (a) scheme framed by GIC of India and approved by Central Government; or (b) scheme framed by any other insurer and approved by IRDA | All assessees as employers | |

| 36(1)(ii) | Bonus or commission paid to employees | All assessees | |

| 36(1)(iii) | Interest on borrowed capital2 | All assessees | |

| 36(1)(iiia) | Pro rata amount of discount on a zero coupon bond based on life of such bond and calculated in prescribed manner | All assessees | |

| 36(1)(iv) | Contributions to recognised provident fund and approved superannuation fund [subject to certain limits and conditions] | All assessees as employers | |

| 36(1)(iva) | Any sum paid by assessee-employer by way of contribution towards a pension scheme, as referred to in section 80CCD, on account of an employee to the extent it does not exceed 10 per cent of the employee’s salary in the previous year. | All assessees as emloyers | |

| 36(1)(v) | Contributions to approved gratuity fund [subject to certain limits and conditions] | All assessees as employers | |

| 36(1)(va) | Contributions to any provident fund or superannuation fund or any fund set up under Employees’ State Insurance Act, 1948 or any other fund for welfare of such employees, received from employees if the same are credited to the employee’s account in relevant fund or funds before due date | All assessees as employers | |

| 36(1)(vi) | Allowance in respect of animals which have died or become permanently useless [subject to certain conditions] | All assessees | |

| 36(1)(vii) | Bad debts which have been written off as irrecoverable [subject to limitation in the case of banks and financial institutions] | All assessees | |

| 36(1)(viia) | Provision for bad and doubtful debts | ||

| ■ up to 8.5 per cent of total income before making any deduction under this clause and Chapter VI-A, and up to 10 per cent of aggregate average advances made by its rural branches | Certain scheduled banks, non-scheduled banks (but other than foreign banks) and co-operative bank (other than primary agricultural credit society or primary co-operative agricultural and rural development bank) | ||

| ■ up to 5 per cent (10% in case of Public Financial Institutions, State Financial Corporations and State Industrial Investment Corporations in any of the two consecutive assessment years 2003-04 and 2004-05 – subject to certain conditions) of total income before making any deduction under this clause and Chapter VI-A | Foreign banks/Public financial institutions/State financial corporations/State industrial investment corporations. Non-Banking Financial Company | ||

| 36(1)(viii) | Amounts transferred to special reserve [subject to certain conditions and maxi-mum of 20 per cent of profits derived from eligible business] | Specified entities, namely, financial corporations/financial corporation which is a public sector company/banking company/co-operative bank other than a primary agricultural credit society or a primary co-operative agricultural and rural development bank/housing finance company/any other financial corporation including a public company | |

| 36(1)(ix) | Expenditure for promoting family planning amongst employees (deductible in 5 equal annual instalments in case of capital expenditure) | Companies | |

| 36(1)(xi) | Expenditure incurred wholly and exclusively by the assessee on or after the 1st April, 1999 but before the 1st April, 2000 in respect of a non-Y2K compliant system, owned by the assessee and used for the purposes of his business or profession, so as to make such system Y2K compliant computer system | All assessees | |

| 36(1)(xii) | Any expenditure (not being in the nature of capital expenditure) incurred by a notified corporation or body corporate, by whatever name called, constituted or established by a Central, State or Provincial Act, for the objects and purposes authorised by the Act under which such corporation or body corporate was constituted or established | Notified corporation or body corporate, by whatever name called, constituted or established by a Central, State or Provincial Act | |

| 36(1)(xiii) | Any banking cash transaction tax paid during the previous year on taxable banking transaction entered into by the assesse | All assessees | |

| 36(1)(xiv) | Contribution to notified credit guarantee trust fund for small industries | Public financial institution | |

| 36(1)(xv) | Securities Transaction Tax paid if corresponding income is included as income under the head ‘Profits and gains of business or profession’ | All assessees | |

| 36(1)(xvi) | Amount equal to commodities transaction tax paid by an assessee in respect of taxable commodities transactions entered into in the course of his business during the previous year, if the income arising from such transactions is included in the income computed under the head “Profits and gains of business or profession” | All assessees | |

| 36(1)(xvii) | Amount of expenditure incurred by a co-operative society for purchase of sugarcane shall be allowed as deduction to the extent of lower of following: a) Actual purchase price of sugarcane; or b) Price of sugarcane fixed or approved by the Government | Co-operative society engaged in business of manufacturing sugar | |

| 36(1)(xviii) | Marked to market loss or other expected loss as computed in accordance with the ICDS notified under section 145(2) | All Assessees | |

| 37(1) | Any other expenditure [not being personal or capital expenditure and expenditure mentioned in sections 30 to 36] laid out wholly and exclusively for purposes of business or profession | All assessees | |

| B. Non-deductible items | |||

| 37(2B) | Advertisement in souvenir, brochure, tract, pamphlet, etc., of political party | All assessees | |

| 40(a)(i) | Interest, royalty, fees for technical services or other chargeable sum payable outside India, or in India to a non-resident or foreign company, on which tax has not been deducted or after deduction, has not been paid on or before the due date of filing of return under section 139(1). Where in respect of any such sum, tax has been deducted in any subsequent year or, has been deducted in the previous year but paid in any subsequent year after the expiry of the time prescribed under sub-section (1) of section 139, such sum shall be allowed as a deduction in computing the income of the previous year in which such tax has been paid6 However, where deductor has failed to deduct the tax and he is not deemed to be an assessee in default under first proviso to section 201(1), then it shall be deemed that the deductor has deducted and paid the tax on the date on which the payee has furnished his return of Income. | All assessees | |

| 40(a)(ia) | Any interest, commission or brokerage, rent, royalty, fees for professional services or fees for technical services payable to a resident, or amounts payable to a contractor or sub-contractor, being resident, for carrying out any work (including supply of labour for carrying out any work), on which tax is deductible at source under Chapter XVII-B and such tax has not been deducted or, after deduction, has not been paid on or before the due date specified in sub-section (1) of section 139. | All assessees | |

| However, where in respect of any such sum, tax has been deducted in any subsequent year, or has been deducted during the previous year but paid after the due date specified in sub-section (1) of section 139, such sum shall be allowed as a deduction in computing the income of the previous year in which such tax has been paid. However, where deductor has failed to deduct the tax and he is not deemed to be an assessee in default under first proviso to section 201(1), then it shall be deemed that the deductor has deducted and paid the tax on the date on which the payee has furnished his return of Income. | |||

| 40(a)(ib) | Any sum paid or payable to a non-resident which is subject to a deduction of Equalisation levy would attract disallowance if such sum was paid without deduction of such levy or if it was deducted but not deposited with the Central Government till the due date of filing of return. | All assessees | |

| However, where in respect of any such sum, Equalisation levy is deducted or deposited in subsequent year, as the case may be, the expenditure so disallowed shall be allowed as deduction in that year. | |||

| 40(a)(ii) | Rate or tax levied on the profits or gains of any business or profession | All assessees | |

| 40(a)(iib) | Amount paid by way of royalty, licence fee, service fee, privilege fee, service charge or any other fee or charge, by whatever name called, which is levied exclusively on, or any amount which is appropriated, whether directly or indirectly, from a State Government undertaking by the State Government | State Govt. undertakings | |

| 40(a)(iii) | Salaries payable outside India, or in India to a non-resident, on which tax has not been paid/deducted at source | All assessees as employers | |

| 40(a)(iv) | Payments to provident fund/other funds for employees’ benefit for which no effective arrangements are made to secure that tax is deducted at source on payments made from such funds which are chargeable to tax as ‘salaries’ | All assessees as employers | |

| 40(a)(v) | Tax actually paid by an employer referred to in section 10(10CC) | All assessees as employers | |

| 40(b) | Interest, salary, bonus, commission or remuneration paid to partners (subject to certain conditions and limits) | Firms | |

| 40(ba) | Interest, salary, bonus, commission or remuneration paid to members (subject to certain conditions and limits) | Association of persons or body of individuals (except a company or a co-operative society, society registered under Societies Registration Act, etc.) | |

| 40A(2) | Expenditure involving payment to relative/director/partner/substantially interested person, etc., which, in the opinion of the Assessing Officer, is excessive or unreasonable | All assessees | |

| 40A(3) | 100% of payments exceeding Rs. 10,000 (Rs. 35,000 in case of payment made for plying, hiring or leasing goods carriages) made to a person in a day otherwise than by account payee cheque/bank draft or use of electronic clearing system through a bank account or through such other electric mode as may be prescribed. (subject to certain conditions) | All assessees | |

| 40A(7) | Any provision for payment of gratuity to employees, other than a provision made for purposes of contribution to approved gratuity fund or for payment of gratuity that has become payable during the year (subject to specified conditions) | All assessees as employers | |

| 40A(9) | Any sum paid for setting up or formation of, or as contribution to, any fund, trust, company, AOP, BOI, Society or other institution, other than recognised provident fund/approved superannuation fund/pension scheme referred to in section 80CCD/approved gratuity fund | All assessees as employers | |

| 40(A)(13) | No deduction shall be allowed in respect of marked to market loss or other unexpected loss except as allowable under section 36(1)(xviii) | All assessee | |

| C. Other deductible items | |||

| 42(1) | In case of mineral oil concerns allowances specified in agreement entered into by Central Government with any person (subject to certain conditions and terms of agreement) | Assessees engaged in prospecting for or extraction or production of mineral oils | |

| 42(2) | In case of mineral oil concerns expenditure incurred remaining unallowed as reduced by proceeds of transfer | Assessee whose business consists of prospecting for or extraction or production of petroleum and natural gas and who transfers any interest in such business | |

| 43B | Any sum which is actually paid, relating to (i) tax/duty/cess/fee levied under any law, (ii) contribution to provident fund/superannuation fund/gratuity fund/any fund for employees’ welfare, (iii) bonus/commission to employees, (iv) interest on loan/borrowing from any public financial institution, State Financial Corporation or State Industrial Investment Corporation (v)interest payments to scheduled banks/Co-operative banks (other than a primary agricultural and development bank)/primary co-operative agricultural and rural development bank on loans or advances, (vi) interest on loan or borrowings from a deposit taking non-banking financial company or systemically important non-deposit taking non-banking financial company and (vii) sum payable by employers by way of leave encashment to employees. (viii) sum payable to the Indian Railways for the use of railway assets. Deduction will not be allowed in year in which liability to pay is incurred unless actual payment is made in that year or before the due date of furnishing of return of income for that year | All assessees | |

| 44A | Expenditure in excess of subscription, etc., received from members (subject to certain conditions and limits) | Trade, professional or similar association | |

| 44C | Head office expenditure (subject to certain conditions and limits) | Non-resident | |

| Against ‘capital gains’ | |||

| 48(i) | Expenditure incurred wholly and exclusively in connection with transfer of capital asset | All assessees | |

| 48(ii) | Cost of acquisition of capital asset and of any improvement thereto (indexed cost of acquisition and indexed cost of improvement, in case of long-term capital assets) | All assessees | |

| 54 | Long-term capital gains on sale of residential house and land appurtenant thereto invested in purchase/construction of another residential house (subject to certain conditions and limits) | Individual/HUF | |

| 54B | Capital gains on transfer of land used for agricultural purposes, by an individual or his parents or a HUF, invested in other land for agricultural purposes (subject to certain conditions and limits) | Individual/HUF | |

| 54D | Capital gains on compulsory acquisition of land or building forming part of an industrial undertaking invested in purchase/construction of other land/building for shifting/re-establishing said undertaking or setting up new industrial undertaking (subject to certain conditions and limits) | Any assessee | |

| 54EE | Long-term capital gain invested in long-term specified assets being units of such fund as may be notified by Central Government to finance start-ups | All assesses | |

| 54F | Net consideration on transfer of long-term capital asset other than residential house invested in residential house (subject to certain conditions and limits) | Individual/HUF | |

| 54G | Capital gain on transfer of machinery, plant, land or building used for the purposes of the business of an industrial undertaking situate in an urban area (transfer being effected for shifting the undertaking to a non-urban area) invested in new machinery, plant, building or land, in the said non-urban area, expenses on shifting, etc. (subject to certain conditions and limits) | Any assessee | |

| 54GA | Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area to any Special Economic Zone (subject to certain conditions and limits) | All assessees | |

| 54GB | Exemption in respect of capital gain arising from the transfer of a long-term capital asset, being a residential property (a house or a plot of land), owned by the eligible assessee, and such assessee before the due date of furnishing of return of income under sub-section (1) of section 139 utilises the net consideration for subscription in the equity shares of an eligible company and such company has, within one year from the date of subscription in equity shares by the assessee, utilised this amount for purchase of specified new asset (subject to certain conditions and limits). | Individual/HUF | |

| W.e.f. April 1, 2017, eligible start-up is also included in definition of eligible company. | |||

Against ‘income from other sources’ A. Deductible items | |||

| 57(i) | Any reasonable sum paid by way of commission or remuneration for purpose of realising dividend | All assessees | |

| 57(i) | Any reasonable sum paid by way of commission or remuneration for the purpose of realising interest on securities | All assessees | |

| 57(ia) | Contributions to any provident fund or superannuation fund or any fund set up under Employees’ State Insurance Act, 1948 or any other fund for welfare of employees, if the same are credited to employees’ accounts in relevant funds before due date | All assessees | |

| 57(ii) | Repairs, insurance, and depreciation of building, plant and machinery and furniture | Assessees engaged in business of letting out of machinery, plant and furniture and buildings on hire | |

| 57(iia) | In case of family pension, 331/3 per cent of such pension or Rs. 15,000, whichever is less | Assessees in receipt of family pension on death of employee being member of assessee’s family | |

| 57(iii) | Any other expenditure (not being capital expenditure) expended wholly and exclusively for earning such income | All assessees | |

| 57(iv) | In case of interest received on compensation or on enhanced compensation referred to in section 145A(2), a deduction of 50 per cent of such income (subject to certain conditions) | All assessees | |

| B. Non-deductible items | |||

| 58(1)(a)(i) | Personal expenses | All assessees | |

| 58(1)(a)(ii) | Interest chargeable to tax which is payable outside India on which tax has not been paid or deducted at source | All assessees | |

| 58(1)(a)(iii) | ‘Salaries’ payable outside India on which no tax is paid or deducted at source | All assessees | |

| 58(1A) | Disallowance due to TDS default (Covered by section 40(a)(ia) and 40(a)(iia)) | All assessees | |

| 58(2) | Expenditure of the nature specified in section 40A | All assessees | |

| 58(4) | Expenditure in connection with winnings from lotteries, crossword puzzles, races, games, gambling or betting | All assessees | |

| For certain payments | |||